|

|

Use this tab to define and connect components and create expressions related to the strategy.

The strategy toolbar displays buttons that correspond to the same functionality as provided through the editing of flows with the Modeler.

![]()

Two buttons in the toolbar are specific to the strategy rule:

- the

button allows you to turn off and turn on strategy auto-run mode, and

button allows you to turn off and turn on strategy auto-run mode, and - the

button allows you to run the strategy rule in the context of a batch run.

button allows you to run the strategy rule in the context of a batch run.

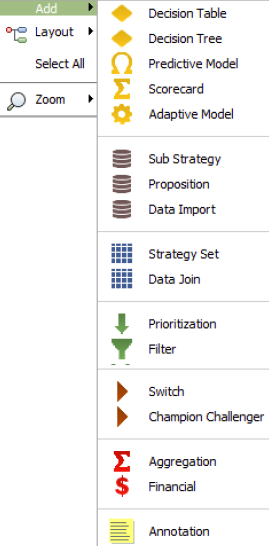

The context menu is accessed by right clicking the working area.

The context menu allows you to perform a number of actions:

- Add components

- Annotate your strategy in the same way as you would do in a flow rule

- Change the layout of the strategy

- Select all components

- Use the zoom options

A strategy is defined by the relationships of the components that are used in the interaction that delivers the decision.

Editing components is done via the Properties dialog of the selected component. This dialog is displayed when you double-click the component or when you right-click the component and select Properties from the context menu. The context menu also allows you to delete the component, but you can also delete it by selecting the component and pressing Delete on your keyboard. The Properties dialog consists of elements common to all components and tabs that are specific to the type of component.

- General settings

- Data import

- Segmentation

- Data enrichment

- Aggregation

- Arbitration

- Selection

General Settings

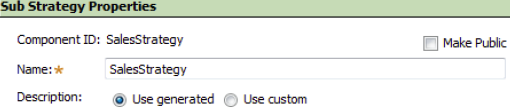

Every component is assigned a default generated name when added to the strategy.

- The Component ID displays the actual name of the component in the clipboard and the name that can be used in expressions.

- The Name allows you to change the default generated name to a meaningful name in the context of the strategy you are designing. Although this field defines the component's Java Identifier, and as such you should follow PRPC naming conventions, you can define names containing space characters.

If the component name contains spaces, the Page Name displays the actual name of the component in the clipboard, and the name that can be used in expressions. The Page Name of a component is the name you defined excluding space characters. - The Make Public option allows you to define components that can be accessed by the rules using the strategy (interaction rule, and other strategy rules).

- The Description allows you to define how to handle the description of the component. If you select Use generated, the component's summary displays information based on the component's configuration. If you select Use custom, you can enter a user-defined description for the component,and have this description shown in the component's summary instead.

The Source tab applies to most components, and displays the components that connect to a given component. In the tab, the order of connected components can be changed by dragging the row up or down. The exception to this pattern are components that belong to the following categories:

- Data import

- Segmentation

- Selection

-

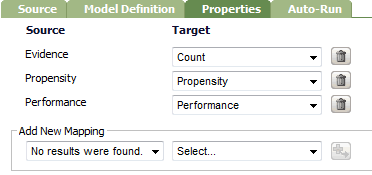

The Properties tab is generic to components that are not selection components. This tab allows you to map the properties brought into the strategy by the component to properties that are strategy properties.

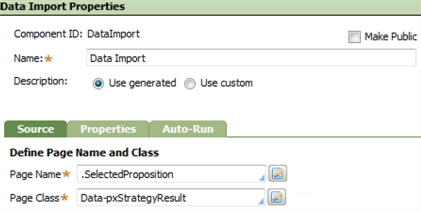

Data Import

Components in this category acquire data or other strategies into the current strategy. The page type determines the type of data import.

- Data import

- Sub strategy

- Proposition

Data Import Properties

In the Source tab, enter the name of the named/embedded page in the Page Name field. If the Page Type is selected to import data from a named page, the Page Class field allows you to provide the class context for the named page. Data import components that refer to named or embedded pages map the page's simple value properties to strategy properties through the Properties tab. If the page name is defined with a dot, for example: .SelectedPosition, the property is an embedded page. If defined without the dot, for example: CustomerPage, the property is a named page. The tab is automatically populated with the page's single value properties.

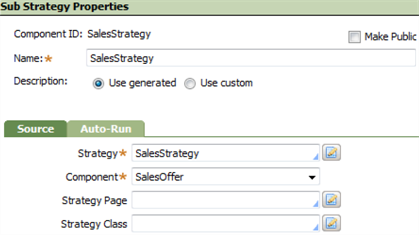

Sub Strategy Properties

Sub strategy components reference other strategy rules. They define the way two strategies are related to each other, access the public components in the strategy they refer to and define how to run the strategy if the strategy is in another class.

In the Source tab select:

- the Strategy rule

- the Component from a list of the public components in the referenced strategy

- the Strategy Page to run on; if left blank, the strategy runs on the Applies To class

- the Strategy Class of the strategy to be imported into the Strategy Class field if the strategy is in another class than the strategy it imports

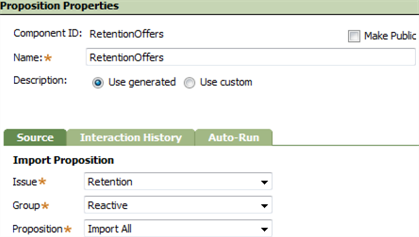

Proposition Properties

Proposition components import propositions defined in the proposition hierarchy.

In the Source tab,

- Select the propositions in the proposition hierarchy.

- Use the Issue and Group drop down lists to select the issue, and group.

- In the Proposition field, you can either import all propositions,or specify a single proposition. It is possible to import all propositions in an issue by selecting the Issue, leaving the Group blank, and selecting the Import All value in this field.

In the Interaction History tab, check the Enable Interaction History option to automatically bring interaction data to the strategy and map the interaction history properties to strategy properties.

Segmentation

Components in this category typically use customer data to segment cases based on characteristics and predicted behavior, placing each case in a segment or score. The segmentation components are:

- Predictive model

- Scorecard

- Adaptive model

- Decision table

- Decision tree

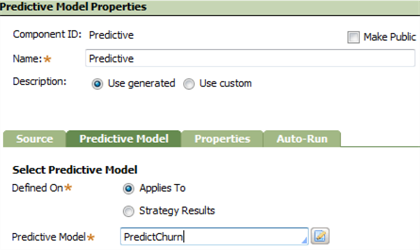

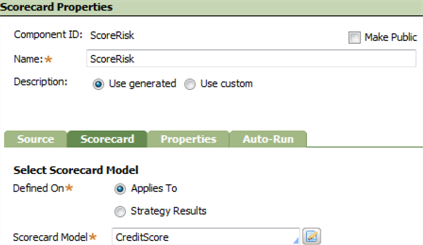

Some common configuration applies to the components. You can:

- Select whether the component should be defined in the AppliesTo class or the Strategy Result class in all components except an adaptive model

- Map the output of corresponding decision rules to strategy properties through the Properties tab of scorecard, predictive model and adaptive model components

- Select the rule the component brings to the strategy in the Rule Name field by selecting an existing rule or create a new rule of the same type.

Predictive Model Properties

Predictive model components reference predictive model rules.

Scorecard Properties

Scorecard components reference scorecard rules.

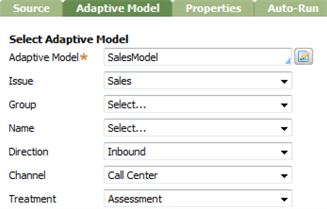

Adaptive Model Properties

Adaptive model components provide segmentation based on adaptive models in ADM. These components reference adaptive model rules in the Adaptive Model tab.

- Select the Adaptive Model rule. Since the scope in the proposition hierarchy is propagated through proposition components, if proposition components connect to the adaptive model component, this field is the only setting available on the tab.

- If proposition components do no connect to the adaptive model, the remaining fields should be set

according to what the scoring model created in ADM is going to model. - Use the Issue, Group, and Name fields to select the hierarchy and proposition defined when managing propositions. Depending on the scope the strategy was added to, Issue and Group fields can be predefined and cannot be changed.

- Use the Direction, Channel, and Treatment fields to select values defined in the IS channel

dimension. -

Decision Table Properties

Decision table components reference decision table rules and can be used to implement characteristic based segmentation by referencing a decision table using customer data to segment on a given trait (for example: salary, age, and mortgage).

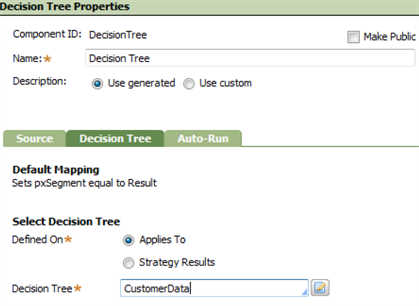

Decision Tree Properties

Decision tree components reference decision tree rules and can often be used for the same purposes as decision tables.

Data Enrichment

Components in this category add information and value to strategies. The components include:

- Strategy set

- Data join

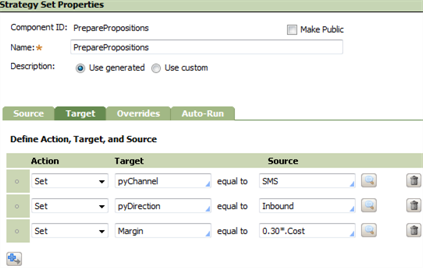

Strategy Set Properties

Strategy set components enrich data by adding information to the components they are connected to. Using strategy set components, you can define personalized data to be delivered when issuing a decision. Personalized data often depends on segmentation components and includes definitions used in the process of creating and controlling a personalized interaction, such as:

- Instructions for the channel system or product/service propositions to be offered including customized scripts, incentives, bonus, channel, revenue, and cost information.

- Probabilities of subsequent behavior, or other variable element.

Strategy set components enrich data through the Properties and Overrides tabs.

Use the Properties tab to add strategy properties for which you want to define default values.

Use the Overrides tab to define property values for each segment available in the strategy. In the Segment field, select the appropriate segment. Use the Properties and Value columns to define properties for the segment you selected. Segments are driven by the segmentation components used in the strategy and can be viewed in the Overview tab of the strategy.

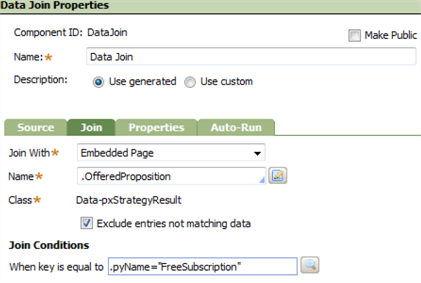

Data Join Properties

Data join components import data from an embedded or named page using a key to match data and map its contents to properties from the imported data to strategy properties. Data join components enrich data through the Data and Properties tabs.

On the Join tab :

- Select the type of page in the Join With field.

- In the Name field:

- When joining data with a named page, select or enter the name of the page.

- When joining data with an embedded page, select or enter the name of the page group.

- The Class field provides the page's class context.

- You can reduce the amount of data to include by checking the Exclude entries not matching data box. This option effectively results in performing an inner join operation.

- In the Join Conditions section, enter the value to match the data on the page.

Aggregation

Two components fall in this category:

- Aggregation

- Financial

Aggregation Properties

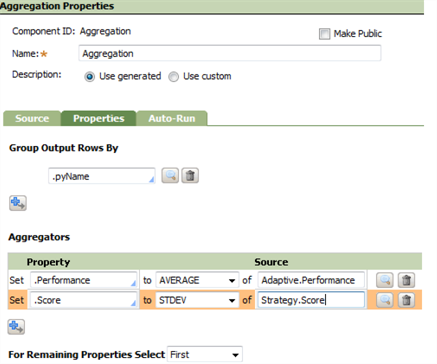

Aggregation components set strategy properties using an aggregation method applied to properties from the source components. The Properties tab of the aggregation component allows you to define the aggregation operations.

- To allow you to use the results of a list of elements, the Group Output Rows By option is available in thee aggregation component. The properties that can be used to group the results are the properties listed in the Strategy Properties tab; that is, properties of Data-pxStrategyResult class and properties available to the strategy depending on its applicability in the context of the proposition hierarchy. For example: selecting grouping by pyName allows you to obtain the list of results for each proposition name.

- In the Aggregators section, select the strategy properties in the Property column, the method for setting the property value based on an expression (SUM, COUNT, FIRST, MIN, MAX, AVERAGE, TRUE IF ALL, TRUE IF NONE, TRUE IF ALL, or STDEV), and type the expression in the Source column.

-

- The properties that can be used in the Property fields are properties listed in the Strategy Properties tab, excluding px properties.

- The properties that can be used in the Source fields are properties of Data-pxStrategyResult class, and properties available to the strategy depending on its applicability in the context of the proposition hierarchy.

- Properties that are not mapped in the component are automatically copied. In the For Remaining Properties Select setting, select how to handle duplication.

-

- None - no duplication

- First - copy with first value

- With Highest - copy with highest value, specifying which property of the SR class corresponding to the level of the strategy in the proposition hierarchy provides the value

- With Lowest - copy with lowest value, specifying which property of the SR class corresponding to the level of the strategy in the proposition hierarchy provides the value

Financial Properties

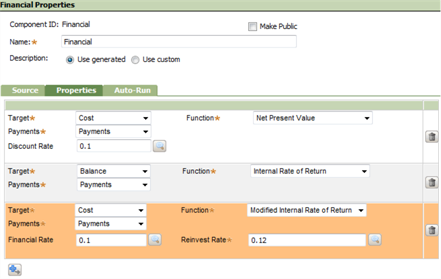

Financial components perform financial calculations using the following functions:

- Internal rate of return calculates the internal rate of return for a series of cash flows.

- Modified internal rate of return calculates the modified internal rate of return for a series of periodic cash flows.

- Net present value calculates the net present value of an investment.

The Properties tab of the financial component allows you to define the financial calculation, and select the properties that provide the arguments for each financial function. The arguments that can be selected from Target and Payments lists are strategy properties of type decimal, double, or integer.

If the value for the arguments is set through source components, the order of the components in the Source tab is important because it is directly related to the order of arguments considered by the function to perform the financial calculation. Typically, the Payments argument should be a list of values, and not a single value. So that you can use a list of values to provide the Payments argument, use a data import component to set the properties to be used by the financial component.

Arbitration

Components in this category filter, rank, or sort the information input by the source components. They include:

- Filter

- Segment Filter

- Prioritization

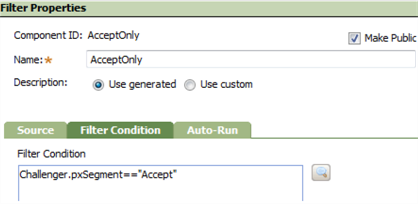

Filter Properties

Filter components apply a filter condition to the outputs of the source components. Filter components express the arbitration through the Filter Condition tab. The Filter Condition field allows you to enter the expression used when filtering the results of the source components.

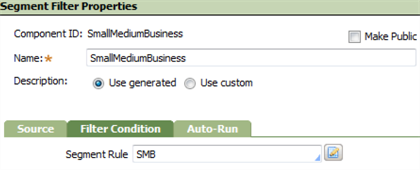

Segment Filter Properties

Segment filter components are only available in a Pega Unified marketing (PUMa) application. They reference a segment rule allowing for determining whether a case falls in a given segment, or not. The arbitration itself is expressed through the segment rule. The segment rule is executed on customer data (the primary page of the strategy) and returns true if the case is part of the segment it represents. Segment components set the pxSegment property to the name of the referenced segment rule. Additionally, segment components also set the pxRank property.

If other components do not connect to the segment component, the component returns a list with a single row (the case is part of the segment), or an empty list (the case is not part of the segment). If there are components that connect to it, the component returns all or no strategy results.

Prioritization Properties

Prioritization components rank the components that connect to it based on the value of a strategy property, or a combination of strategy properties. These components can be used to determine the service/product offer predicted to have the highest level of interest, or profit. Prioritization components express the arbitration through the Prioritization tab.

- Two modes can be used to order the results. The mode in which the results are ordered according to priority values or the mode in which results are ordered alphabetically. Each mode toggles its own settings. If Prioritize Values is selected, Order By settings display. If Sort Alphabetical is selected, Sort settings display.

- The Expression field is used to define the property or properties providing prioritization criteria through an expression

- The Output settings define how many results should be considered in the arbitration. The Top option considers the first results as specified in the field next to it and All considers all results.

Selection

Strategies must be balanced to determine the most important issue when interacting with a customer. The first step in creating this flow is to use prioritization components in the strategy to filter the possible alternatives (for example: determining the most interesting proposition for a given customer).

The second step is to balance your company’s different objectives by defining the conditions when one strategy should take precedence over another. This optimization can be accomplished by selection component that can select the decision path based on a condition, and can also be used to test alternative strategies. Using selection components, the assignment of a particular customer to a possible alternative can be random.

Selection components include:

- Champion challenger

- Switch

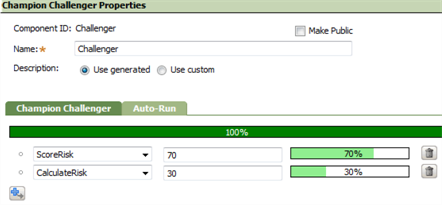

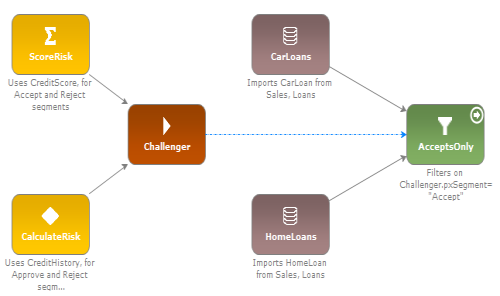

Champion Challenger Properties

Champion challenger components randomly allocate customers between two or more alternative components, thus allowing for testing the effectiveness of various alternatives. For example, you can specify that 70% of customers are offered product X, and 30% are offered product Y. They express component selection through the Champion Challenger tab. Add as many rows as alternative paths for the decision as necessary, and define the percentage of cases for each decision path. All alternative decision paths need to add up to 100%.

Switch Properties

Switch components select between components on the basis of specified conditions. These components are typically used to select different issues (such as interest and risk), or they select a component based on customer characteristics, or the current situation. For example, a case can be allocated to a sub-network dealing with recent customers with little history, or to a sub-network dealing with long-standing customers. They express component selection through the Switch tab. Add as many rows as alternative paths for the decision as necessary, use the Select list to select the component, and enter the selection criteria as an expression in the If field. The component selected from the Otherwise list is always selected when the condition expressed in the If field is not met.

You can connect components by selecting a component, and dragging the arrow to another component. Alternatively, you can use a strategy component's Source tab.

Selecting one component is performed by mouse over on the center area of the component until the  icon is displayed. For components that select other components, the connections established this way determine the entries in the component's Source tab (the connected to component) or, for selection components, the Switch or Champion Challenger tabs.

icon is displayed. For components that select other components, the connections established this way determine the entries in the component's Source tab (the connected to component) or, for selection components, the Switch or Champion Challenger tabs.

Note that this method of connecting components does not fully define the relationship between the components. In the example above, this method would have connected the components, but you would still need to define the percentage of cases when each component should be selected.

Another type of connection represented by dotted blue arrows is displayed when a component is used in another through expressions. If the component is also referenced in the source tab of the component it connects to, a thicker gray arrow is displayed.

Expressions in Strategies

Working with strategies means working with the strategy result data classes and the Applies To class of the strategy rule. These classes can be combined in expressions or by introducing segmentation components that work on the strategy result data class and not the Applies To class.

The context of an expression is always the strategy result class (using the dot notation in the SmartPrompt accesses this context). For example: .pyPropensity.

To use properties of the Applies To context, you must declare the primary page. For example, Primary.Price.

To use properties of one strategy component in another, you must declare the name of the component. For example, ChurnModel.churnrate. If the component used in the expression outputs a list (multiple results), only the first element in the result list is considered when computing the expression.

Financial Functions

You can use the financial functions available in the Financial library to perform financial calculations. The following functions are provided in the Financial library:

Function |

Name |

Calculates |

| cumipmt | Cumulative Interest |

The cumulative interest paid on a loan for a given period of time taking the following arguments:

|

| cumprinc | Cumulative Principal |

The cumulative principal paid on a loan for a given period of time taking the same arguments as described in the cumulative interest paid function . |

| db | Depreciation Using Fixed-Declining Balance |

The depreciation of an asset using the fixed-declining balance method, a method that computes the depreciation at a fixed rate. This function takes the following arguments:

|

| dbb | Depreciation using Double Declining Balance | The depreciation of an asset using the double-declining balance method, or some user specified method. The four initial arguments are similar to the ones used with the fixed-declining balance function . The fifth factor argument is applied to provide the rate at which the balance declines (default is assumed to be 2). |

| fv | Future Value |

The future value of an investment taking the following arguments:

|

| ipmt | Interest Payment | The interest payment for a given period for an investment taking the interest rate, period, number of periods, and present value arguments, optionally using the future value and type arguments. |

| nper | Number of Periods | The number of periods for an investment, optionally using the future value, and starting the calculation at the beginning of the period (use true in this case). The function assumes that periodic and constant payments are made, and that the interest rate is constant. |

| pmt | Payment | The payment of a loan based on constant interest rate and constant payments taking the same arguments as described in the interest payment function. Typically, the payment contains principal and interest, and no other fees, or taxes. |

| ppmt | Principal Payment | The payment on the principal for a given period of an investment based on periodic, constant payments, and constant interest rate. This function takes the same arguments as described in the interest payment function. This calculation can also be expressed by payment minus interest payment. |

| pv | Present Value | The net present value, optionally using the future value, and calculating the function at the beginning of the period (use type false in this case). The function assumes that periodic and constant payments are made, and that the interest rate is constant. |

| rate | Rate | The interest rate per period of an annuity, optionally using the future value, and calculating the function at the beginning of the period. This function takes the number of periods, payment, and present value arguments, optionally taking into account the future value and type arguments. |

| sin | Straight-Line Depreciation | The straight-line depreciation of an asset for one period in the life of an asset. Cost, salvage, and life arguments are explained in the depreciation function. |

| syd | Sum-of-Years Depreciation | The sum-of-years' digits depreciation of an asset after a specified period taking the same arguments as described in the depreciation function. |

| vdb | Variable Depreciation |

The depreciation of an asset for any specified period. The depreciation calculation is variable and uses the double-declining balance method, or a user-specified method. The arguments are quite similar to the ones used in the double-declining depreciation function. Three extra arguments apply:

|

![]() When providing the arguments:

When providing the arguments:

- Rate and number of periods must be calculated using the same period unit. For example, if the rate is calculated in months, the number of periods should also be expressed in months.

- Payments should be expressed as an array of negative numeric values.

- Incomes/loans should be expressed as an array of positive numeric values.

Strategy rule form

Strategy rule form Toolbar and Context Menu

Toolbar and Context Menu About Strategy rules

About Strategy rules