Customer service agents at any large enterprise have a complex, critical job, but at financial services institutions, those teams face a distinct set of challenges. In both retail and commercial banking, agents must not only be able to understand and articulate a variety of financial products and services but also know which customers qualify for those offerings. They should understand which customers represent excellent lifetime value – and are therefore worth offering the best available rates, discounts, and products – versus those that might expose the institution to unnecessary financial risk. Plus, the constantly changing world of regulations and disclosures can cause headaches for customer service providers, alongside their business, operations, and IT leadership.

In this article, we’ll take a closer look at how Pega Customer Service 8.8 builds AI and automation into FS workflows to help organizations resolve customer inquiries faster, resulting in better outcomes for the customer and the enterprise. Along the way, we’ll discuss how Pega-powered financial institutions streamline operations to protect the bottom line.

Faster customer self-service and seamless escalations

In general, the customer service industry is trending in the direction of faster, better, and more ubiquitous self-service options. Most customers would happily resolve their own quick inquiry than be shepherded to an agent. In banking, that holds true as well – but sometimes even relatively simple requests require approval up the chain. So it’s important that Chat Bots and IVRs be equipped not only to help customers self-serve but also to identify instances where that customer would be better served by a live agent.

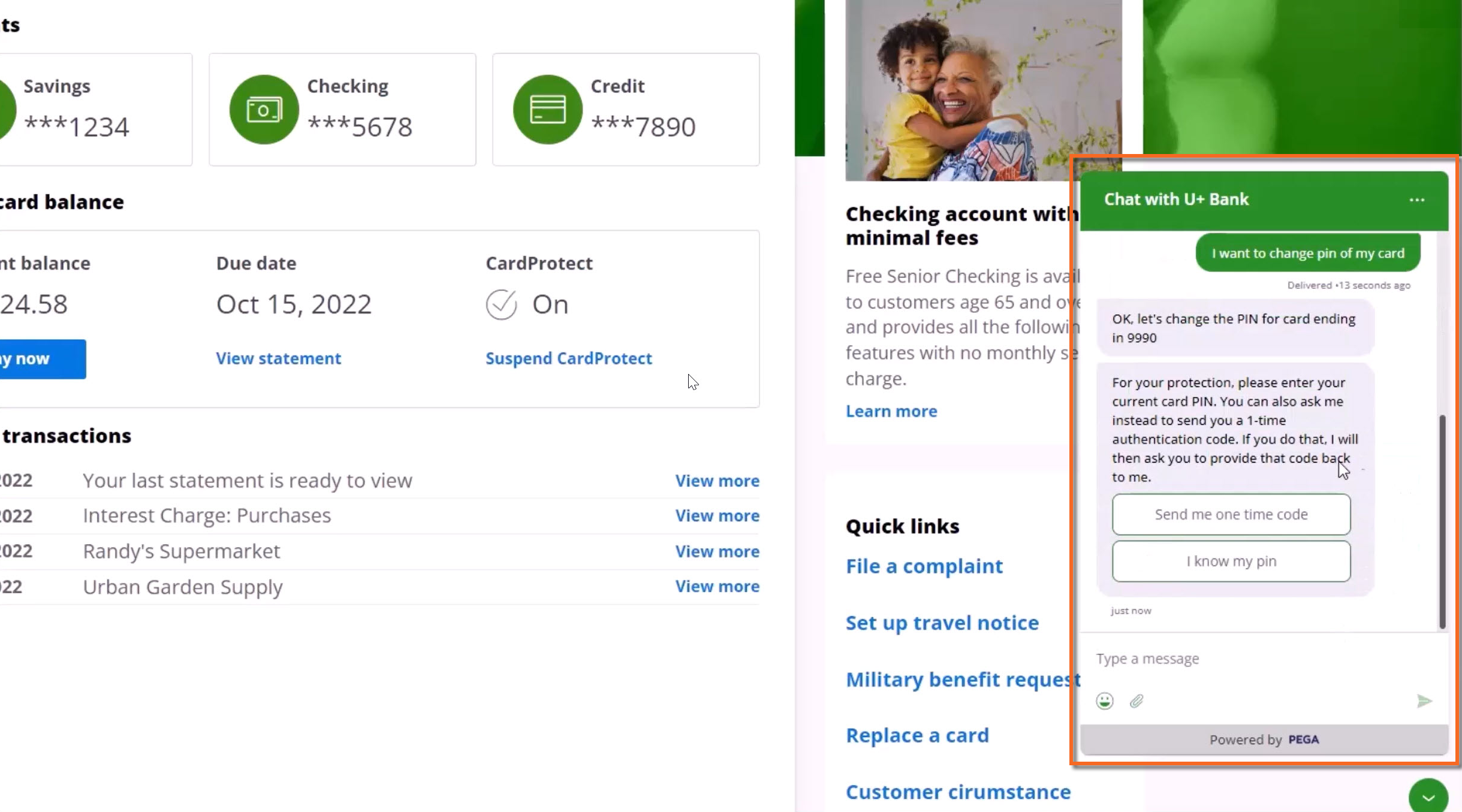

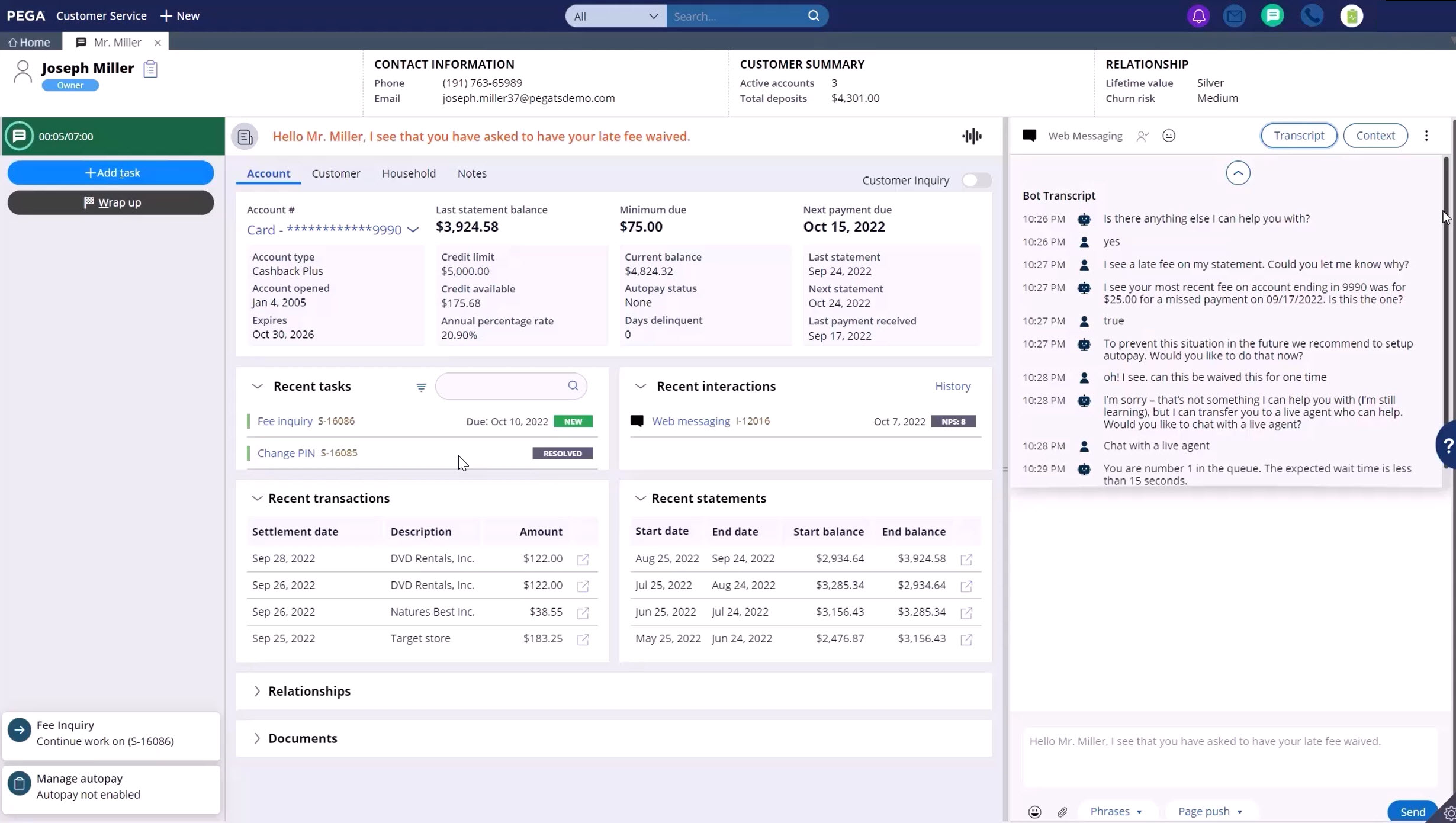

Consider the customer in the screenshots below. Joseph needs to change his PIN, which he can do quickly and efficiently using just Pega’s intelligent Chat Bot, without the help of a live agent. But he also wants to inquire about a late payment and hopes to have the fee waived. Joseph hasn’t been the best customer, so waiving the fee requires conditional approval from a supervisor. In this case, the agent takes the reins from the Chat Bot, retaining the interaction context and customer history. Joseph continues the conversation in the same chat interface as before, only now he’s speaking with a live agent.

It’s worth pointing out some of the technologies working in concert in this somewhat common scenario: Chat Bot, Natural Language Processing, decisioning models, live data, Conversational AI, augmented agent assistant, automated call wrap-up. All of these helps provide a seamless experience for customers and automate work off the desk of agents.

AI-powered next-best-actions to uncover opportunity

Something else savvy contact center leaders are looking forward to is the possibility of turning the contact center into a revenue center by empowering agents to handle basic upsell and cross-sell opportunities. That doesn’t mean agents will suddenly become sellers – but it does gesture toward the trend of prioritizing customer lifetime value and revenue-based metrics.

For financial institutions, rewarding good customers with exclusive product offerings not only generates a revenue opportunity for the organization but also helps to solidify the customer relationship. Maybe it’s offering a banking customer a competitive mortgage rate or extending additional credit to a longtime business client.

The easiest way to empower agents to execute these offers is to leverage Pega’s Next Best Action Advisor, powered by Customer Service and Customer Decision Hub. The tool uses AI and decisioning to give agents the right offer to present to the customer based on ongoing conversational inputs and behavioral algorithms. When the context changes, so does the top-rated, next-best offer.

Watch the demo to see how easy Pega makes it for agents to deliver the right offer at the right moment, to recalibrate the next best action on the fly:

Transform customer service without replacing the desktop

Banks that have already invested in another customer service desktop can still leverage Pega’s technology using the DX API, embedding workflow automation, case management, and process orchestration for better customer outcomes.

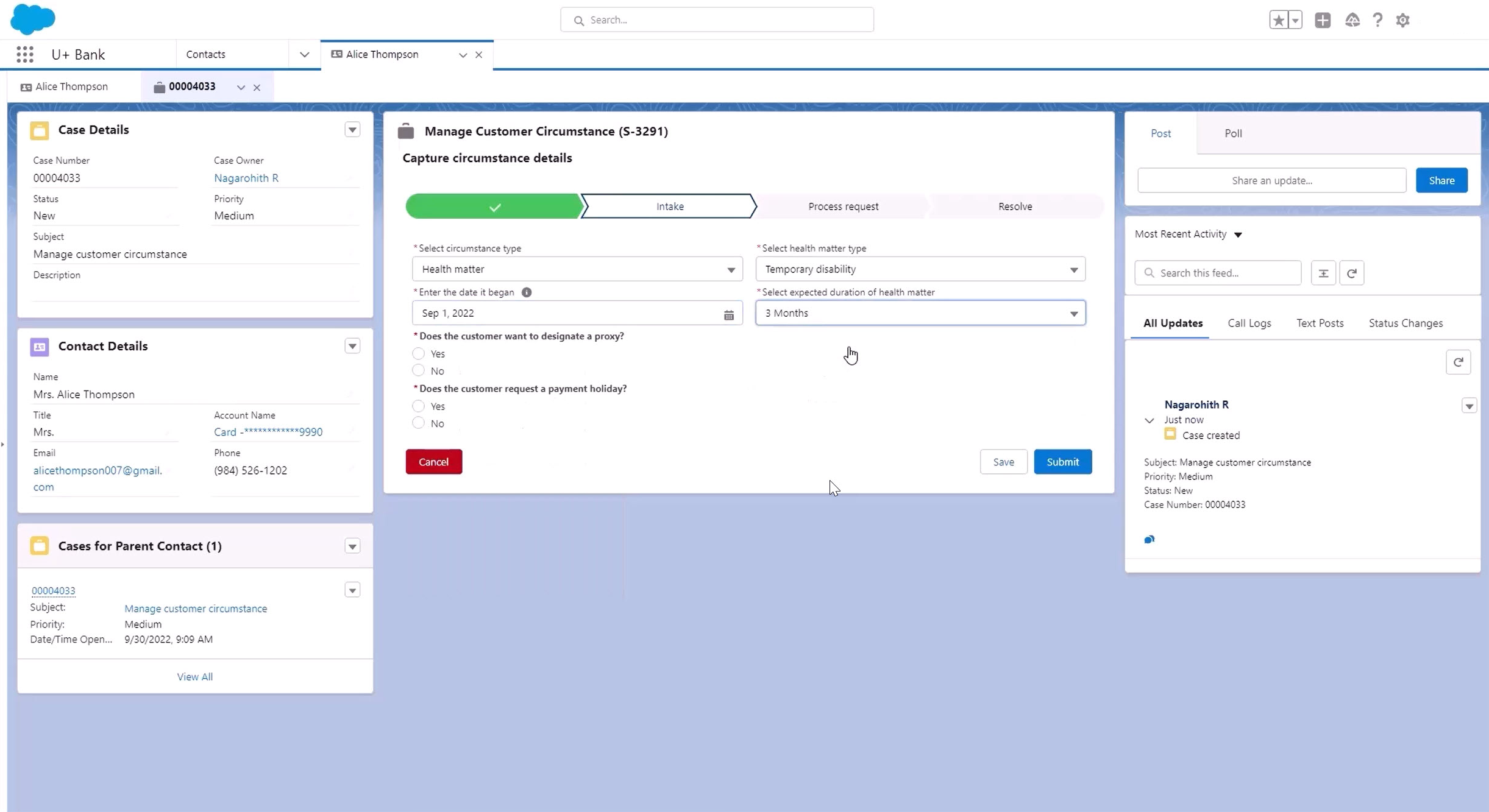

For example, consider a banking customer interacting with the institution’s IVR to address a late payment – like the Chat Bot interaction in the first example in this article. Only in this case, when the IVR needs to escalate to a live agent to handle an additional, more complex request, that agent uses a non-Pega desktop. But Pega cases integrate seamlessly with those from other CRM tools so the agent can pick up right where the IVR left off, as we can see below.

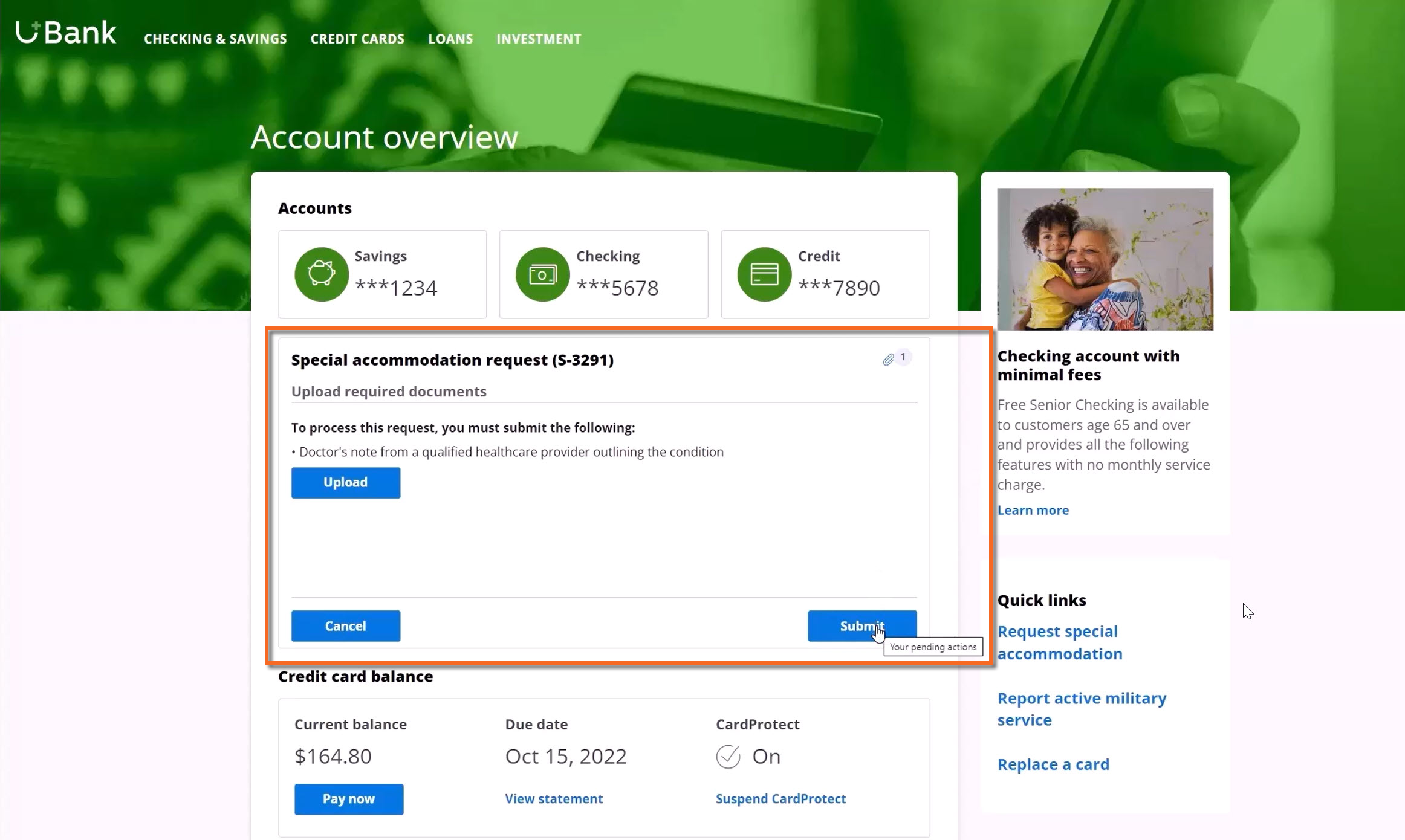

What’s more, the bank’s web self-service portal is also connected to that same center-out architecture. So when this customer uploads documents through the portal, a pre-configured SLA triggers an action on the agent’s part, routing the case to the back office for processing. All of this happens in a non-Pega desktop that still runs on Pega Customer Service technology via Process Extender and DX API.

This was a brief look at three ways financial institutions can lean on Pega Customer Service, including the latest capabilities in version 8.8, to automate service from the center out using powerful case management, featuring out-of-the-box workflows and a data model tailored for banks. For more, take a look at how institutions like First Tech Federal Credit Union have dramatically reduced handle times, bumped NPS, and connected and consolidated legacy systems using Pega Customer Service for Financial Services.

Don't Forget

- JOIN THE CONVERSATION on Support Center

- FOLLOW @PegaDeveloper on Twitter